- Buying tenants insurance with insurance coverage for personal effects is a smart action.For example, your plan might repay you if a kitchen area fire damages the apartment or condo.Property owners can make insurance claims for problems such as loss of rental income if the house is damaged and you can not rent it out.You also might be in charge of spending for economic damages if you're sued.For example, repayment for stolen precious jewelry is typically capped at $1,500, no matter exactly how valuable it is.

Other Essential Points To Find Out About Occupants Insurance Policy

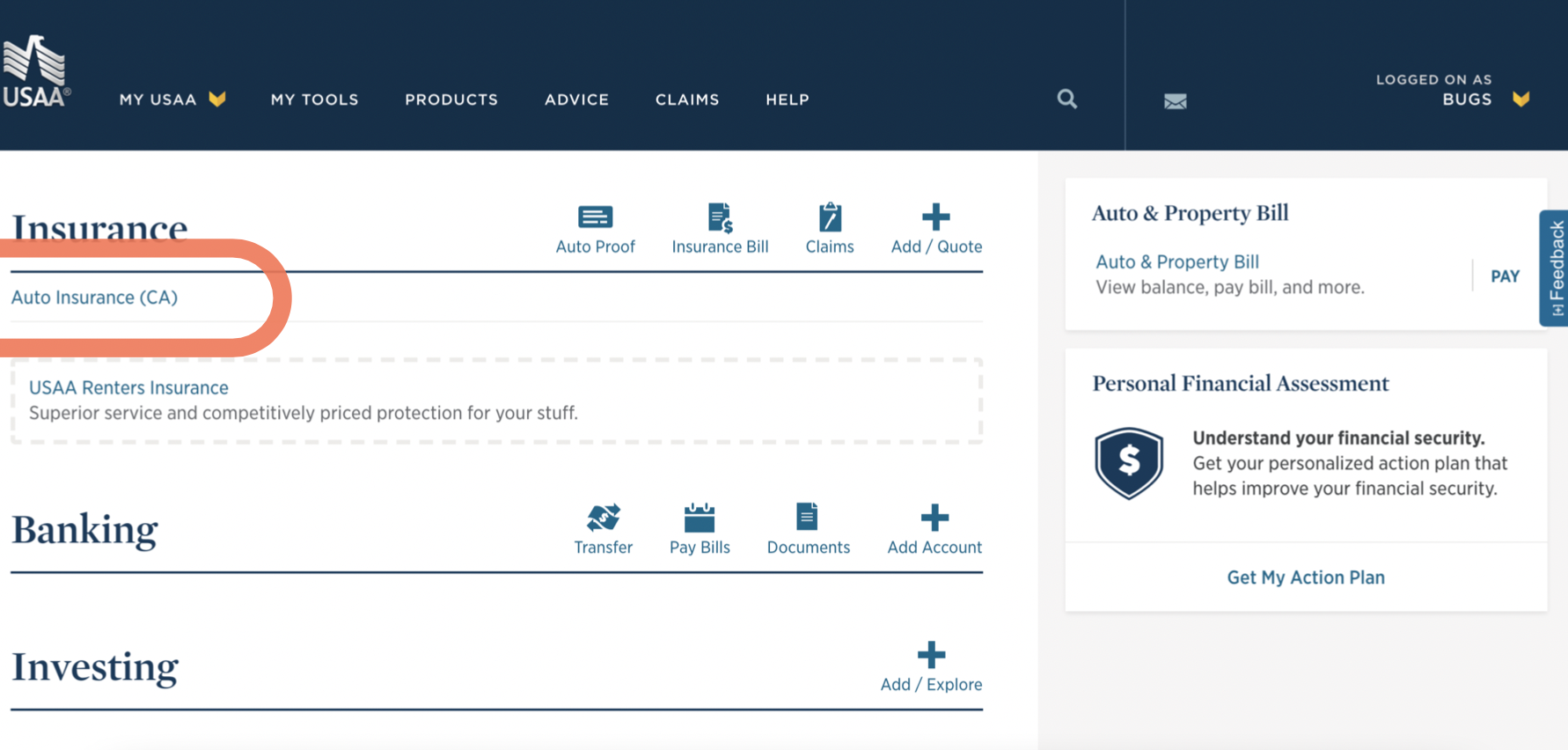

Legitimately, proprietors can not secure an insurance plan to cover the personal items of the tenant. Similarly, a tenant can not legally obtain an insurance policy to cover building that is had by someone else, i.e. the leasing they are staying in. An insurance holder's personal liability insurance pays for covered losses and damages received by 3rd parties, along with associated legal costs. An occupant's insurance coverage protects versus losses to your personal effects, including clothing, fashion jewelry, luggage, computer systems, furnishings, and electronic devices. Your renters insurance policy sticks to you anywhere you go, such as to a buddy's home or purchasing. If you overturn a display of glass plates in a shop, for example, your occupants insurance policy may cover the damages. Discover how proprietors take advantage of tenants insurance coverage, shielding both property and renter items. Obligation defense might likewise save you from out-of-pocket expenses if you was accountable for someone's injury while they were at your home.A Win-win For Occupants And Property Managers Alike

So, it is essential to have the best mobile home renters insurance policy below, also. Residing in a mobile home may raise your direct exposure to crucial dangers, which subsequently makes tenants insurance a lot more crucial. For example, a mobile home might be extra vulnerable to damage from a serious climate event like a hurricane or cyclone. That implies your valuables may go to even more risk for damage contrasted to a residence or apartment or condo. A landlord insurance coverage can set you back regarding 25% more than a similar homeowners plan, according to the Insurance policy Information Institute. Tenants Insurance can protect your belongings, such as laptop computers or fashion jewelry from theft or damages.State Farm Renters Insurance Review 2024 - MarketWatch

State Farm Renters Insurance Review 2024.

Posted: Mon, 12 Feb 2024 08:00:00 GMT [source]